Smart Marketing Tactics for U.S. Alcohol Brands

Introduction

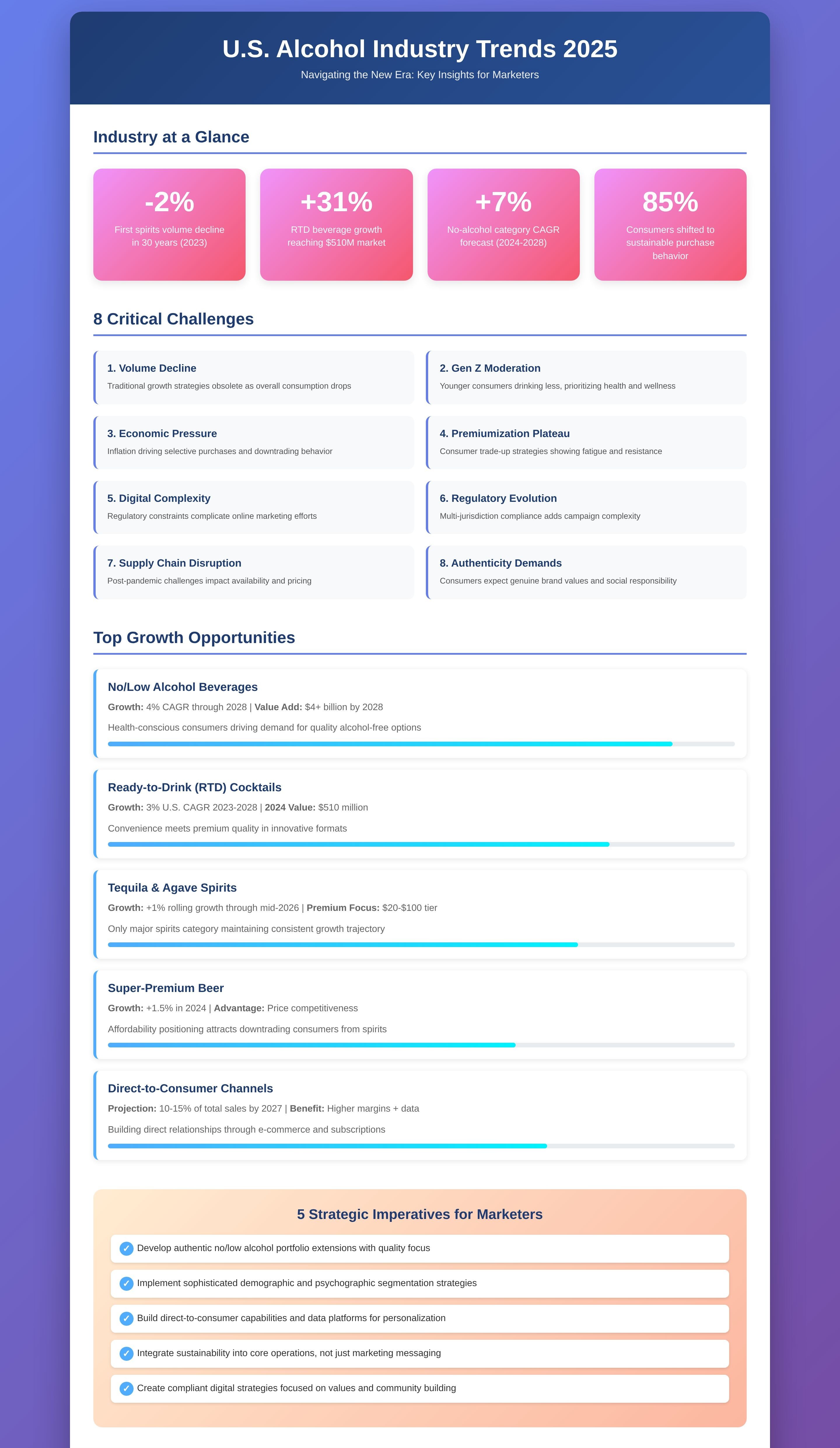

The U.S. alcohol industry is undergoing unprecedented transformation as it navigates shifting consumer preferences, economic pressures, and generational changes. For the first time in nearly 30 years, the U.S. spirits market experienced volume declines in 2023, signaling a fundamental shift in drinking behaviors and purchase patterns. This white paper examines the critical challenges facing alcohol marketers today and provides actionable strategies for success in an increasingly complex marketplace.

Key findings reveal that Gen Z consumers are driving a "sober curious" movement, with 23% growth in no-alcohol beer between 2019-2024. Meanwhile, premiumization continues to be the primary growth driver, with super-premium segments showing resilience even as overall volumes decline. Ready-to-drink (RTD) beverages are experiencing explosive growth, representing a $510 million market that grew 31% in 2023.

This comprehensive analysis addresses eight critical industry challenges, from changing demographic preferences to supply chain disruptions, while highlighting emerging opportunities in health-conscious segments, direct-to-consumer channels, and innovative product categories. For alcohol marketers, understanding these trends is essential for developing effective strategies that resonate with evolving consumer expectations while maintaining profitability in a challenging economic environment.

The white paper concludes with five actionable recommendations for marketers, including the development of low/no-alcohol product lines, implementation of omnichannel distribution strategies, and creation of authentic brand narratives that appeal to younger consumers' values-driven purchasing decisions.

Key Industry Challenges

1. Declining Overall Volume Consumption

For the first time in nearly 30 years, IWSR recorded a decline (-2% in 2023) in the volume of spirits sold in the key US market. This represents a fundamental shift in American drinking habits, forcing marketers to reimagine traditional volume-based growth strategies.

2. Gen Z's "Sober Curious" Movement

Gen Z is drinking less alcohol than previous generations. This generational shift toward moderation and health consciousness is reshaping the entire industry landscape and requiring new marketing approaches.

3. Economic Pressure on Consumer Spending

In mature markets such as the US and Europe, stubbornly high inflation rates continue to pressurise consumer purchasing decisions, leading to more selective buying behaviors and increased price sensitivity.

4. Premiumization Plateau

Spirits sales from US wholesalers to retailers are predicted to continue declining during 2025 as premiumisation slows. The long-standing strategy of trading up consumers to higher-priced products is showing signs of fatigue.

5. Digital Marketing Complexity

These consumers have distinct preferences, behaviors, and attitudes toward alcohol consumption, shaped by digital connectivity, health consciousness, social values, and budget constraints. Navigating digital platforms while adhering to alcohol advertising regulations presents ongoing challenges.

6. Regulatory and Compliance Pressures

The alcohol beverage industry experienced significant regulatory evolution in 2024, with Florida leading substantial legislative changes while national trends reshape market dynamics. Staying compliant across multiple jurisdictions adds complexity to marketing campaigns.

7. Supply Chain and Distribution Disruptions

Post-pandemic supply chain challenges continue to impact product availability and pricing, affecting marketing timing and promotional strategies across all alcohol categories.

8. Brand Authenticity Expectations

Younger consumers demand genuine brand stories and social responsibility, making traditional advertising approaches less effective and requiring more authentic engagement strategies.

Current Industry Trends and Innovations

1. Ready-to-Drink (RTD) Beverage Explosion

Sales of non-alcoholic beers, wine, and spirits spiked 31% last year in a market valued at $510 million. RTD beverages offer convenience and innovation, with brands like Absolut and Ocean Spray or Captain Morgan and Pepsi creating crossover partnerships that appeal to new consumer segments.

2. No/Low-Alcohol Market Growth

For no-alcohol beer, the CAGR was +23% between 2019 and 2024, with a "forecast CAGR of +18% to 2029." This represents one of the fastest-growing segments in the beverage industry, driven by health-conscious consumers.

3. Super-Premium Segment Resilience

Super premium beer (+1.5%). IWSR also reported that "the only price band to see growth" in the U.S. in 2024 was super-premium beer. Despite overall volume declines, consumers continue to trade up when they do purchase alcohol.

4. Tequila and Agave Spirits Boom

Tequila and other agave spirits have been booming for decades, and they seem poised to continue their meteoric ascent. Celebrity endorsements and premium positioning have made tequila the fastest-growing spirits category.

5. Health-Conscious Consumer Segment Dominance

The health-conscious consumer segment held the dominating share of the non-alcoholic beverages market in 2024. This trend extends to alcoholic beverages, with consumers seeking lower-calorie and organic options.

Introduction: The Great Reset

The American alcohol industry stands at an inflection point. For the first time in nearly 30 years, IWSR recorded a decline (-2% in 2023) in the volume of spirits sold in the key US market. This statistic represents more than a temporary market dip—it signals a fundamental transformation in how Americans approach alcohol consumption.

For decades, the industry operated on predictable patterns: consistent volume growth, successful premiumization strategies, and generational continuity in drinking preferences. Today's reality is starkly different. In 2024, Beverage Alcohol struggled to achieve value and volume sales growth, but the industry is set to navigate a dynamic year in 2025, with shifting consumer preferences and macroeconomic factors redefining the market landscape.

This transformation isn't merely cyclical—it's structural. The convergence of health consciousness, economic pressures, generational preferences, and social media influence has created a perfect storm of change. From the rise of health-conscious and sustainability-driven choices to the growing influence of younger generations like Gen Z (of legal drinking age), every traditional assumption about alcohol marketing requires reexamination.

The purpose of this white paper is to provide alcohol marketers with a comprehensive understanding of these seismic shifts and, more importantly, actionable strategies for thriving within them. We'll examine eight critical challenges facing the industry, analyze five key trends reshaping consumer behavior, and explore real-world case studies of brands successfully navigating this new landscape.

Marketers reading this paper will gain insights into the "sober curious" movement, understand why sales of non-alcoholic beers, wine, and spirits spiked 31% last year in a market valued at $510 million, and learn how to position their brands for success in an era where traditional marketing playbooks no longer guarantee results.

The stakes couldn't be higher. Brands that understand and adapt to these changes will capture market share and build lasting consumer relationships. Those that don't risk obsolescence in an industry undergoing its most dramatic transformation in generations. The following analysis provides the roadmap for making the right strategic choices.

Industry Context: Understanding the New Landscape

The U.S. alcohol industry's current challenges stem from a confluence of factors that have fundamentally altered the competitive landscape. To understand where the industry is heading, marketers must first grasp the magnitude of recent changes and their underlying drivers.

The Post-Pandemic Reset

In the years following the pandemic, the alcohol industry went through a reset period that was felt across several industry verticals, most notably in 2023. This reset wasn't simply about returning to pre-pandemic norms—it represented a permanent shift in consumer behavior, distribution channels, and purchasing patterns.

During the pandemic, alcohol consumption initially surged as consumers stockpiled products and restaurants closed. However, this artificial boost masked developing trends toward moderation and health consciousness that became apparent once normal social patterns resumed. The industry now faces the reality that pandemic consumption levels were an anomaly, not a new baseline.

Economic Pressures and Consumer Adaptation

After persistent inflation, geopolitical tensions, and varying levels of consumer confidence characterised 2025, the next 12 months will be marked by continued economic uncertainty, but also several promising growth opportunities. These economic pressures have forced consumers to become more selective in their alcohol purchases, prioritizing quality over quantity and seeking value in different ways than previous generations.

The traditional model of volume growth through broad market expansion has given way to a more nuanced approach focusing on specific consumer segments and occasions. Marketers must now consider not just what consumers want to drink, but when, where, and why they're willing to spend their discretionary income on alcohol.

Regulatory Evolution and Market Dynamics

Florida's wine industry, contributing over $15 billion annually to the state's economy and ranking second only to California in production, marked a milestone as states continue to modernize their alcohol regulations. These regulatory changes create both opportunities and challenges for marketers, requiring constant adaptation to new rules around direct-to-consumer sales, digital advertising, and cross-border distribution.

The regulatory landscape's evolution reflects broader social attitudes toward alcohol, with policymakers balancing public health concerns against economic benefits. This creates a complex environment where marketers must navigate not just legal requirements, but also shifting social expectations about responsible marketing practices.

The Digital Transformation Challenge

Unlike many consumer categories, alcohol marketing faces unique digital constraints due to regulatory requirements and platform policies. These limitations have forced brands to become more creative in their approach to digital engagement, leading to innovative partnerships, content strategies, and community-building initiatives that comply with restrictions while still effectively reaching target audiences.

The challenge is compounded by generational differences in media consumption, with younger consumers primarily engaging through digital channels that have strict alcohol advertising policies. This has created a need for more subtle, authentic forms of marketing that focus on brand values and lifestyle alignment rather than direct product promotion.

Challenge Analysis: Eight Critical Pain Points

Challenge 1: Volume Decline Across Core Categories

The most fundamental challenge facing alcohol marketers is the unprecedented decline in overall consumption volumes. Meanwhile, global total beverage alcohol (TBA) declined -1% by volume and rose +2% by value (US$, variable exchange rate) in 2023. This pattern—declining volumes but growing values—indicates that successful brands are those that can command premium pricing despite lower consumption.

Strategic Implications:

- Traditional volume-based growth strategies must be replaced with value-focused approaches

- Portfolio optimization becomes critical as brands focus on their most profitable segments

- Marketing budgets need reallocation from broad awareness campaigns to targeted, high-value consumer engagement

Solutions and Best Practices: Successful brands are responding by developing limited-edition products, creating exclusive experiences, and building direct relationships with their most valuable consumers. The focus shifts from acquiring new drinkers to deepening engagement with existing customers who are willing to pay premium prices for exceptional quality and experiences.

Challenge 2: The Gen Z Consumption Paradigm

Why Gen Z drinks less, what they sip instead, and how alcohol brands can still win their hearts has become the industry's most pressing question. This generation's approach to alcohol is fundamentally different from their predecessors, characterized by moderation, health consciousness, and different social drinking patterns.

Strategic Implications:

- Traditional marketing messages about social bonding through alcohol consumption resonate less with Gen Z

- Health and wellness considerations now influence alcohol purchase decisions

- Social media presence and brand values alignment become more important than traditional advertising

Solutions and Best Practices: Brands succeeding with Gen Z focus on quality over quantity, emphasize natural ingredients and sustainable practices, and create experiences that align with this generation's values. Marketing messages shift from promoting consumption to celebrating occasions and lifestyle choices that include alcohol as one option among many.

Challenge 3: Economic Pressures and Price Sensitivity

Budget constraints significantly impact how younger consumers approach alcohol purchases. Unlike previous generations who might have regularly purchased alcohol for home consumption, current consumers are more likely to reserve alcohol purchases for special occasions or specific social situations.

Strategic Implications:

- Value proposition messaging must extend beyond price to include quality, experience, and brand values

- Promotional strategies need refinement to avoid devaluing premium positioning

- Package sizes and price points require optimization for occasional purchase patterns

Solutions and Best Practices: Leading brands are developing tiered product lines that offer entry points at various price levels while maintaining premium brand positioning. They're also creating value through packaging innovations, limited editions, and experiential marketing that justifies premium pricing even in economically challenging times.

Challenge 4: Premiumization Fatigue

Premiumisation slows as consumers become more discerning about what justifies higher prices. The automatic assumption that consumers will continuously trade up to more expensive products no longer holds true across all categories and demographics.

Strategic Implications:

- Premium positioning must be supported by genuine product differentiation and compelling brand stories

- Value demonstration becomes crucial as consumers scrutinize premium claims more carefully

- Brand authenticity and transparency increase in importance as consumers research products more thoroughly

Solutions and Best Practices: Successful premium brands are investing heavily in product innovation, sustainable practices, and transparent communication about their production processes. They're also focusing on creating genuine scarcity through limited production runs rather than artificial scarcity through marketing tactics.

Challenge 5: Digital Marketing Regulatory Constraints

Alcohol marketing faces unique challenges in digital spaces due to platform restrictions and regulatory requirements. These constraints require creative approaches to reach target audiences while remaining compliant with both platform policies and federal regulations.

Strategic Implications:

- Content marketing and brand storytelling become more important than direct product promotion

- Influencer partnerships require careful vetting and contract management to ensure compliance

- Community building and organic engagement strategies gain importance over paid advertising

Solutions and Best Practices: Brands are developing content strategies that focus on lifestyle, culture, and values rather than direct product promotion. They're also investing in owned media properties and direct consumer relationships that aren't subject to platform restrictions.

Challenge 6: Supply Chain and Distribution Complexity

Post-pandemic supply chain disruptions continue to impact product availability, pricing, and promotional timing. These operational challenges directly affect marketing strategy execution and require greater flexibility in campaign planning.

Strategic Implications:

- Marketing campaigns must build in greater flexibility for product availability fluctuations

- Regional variation in product availability requires localized marketing approaches

- Pricing strategy must account for supply chain cost volatility

Solutions and Best Practices: Leading brands are developing more agile marketing operations that can quickly adapt to supply chain changes. They're also investing in supply chain transparency as a marketing differentiator, particularly with sustainability-conscious consumers.

Challenge 7: Authenticity and Values Alignment

They drink less, post more and prefer their cocktails canned, collabed and content-friendly. Modern consumers expect brands to demonstrate authentic commitment to social and environmental causes rather than superficial marketing campaigns.

Strategic Implications:

- Brand values must be integrated into all business operations, not just marketing communications

- Social responsibility initiatives require long-term commitment and measurable impact

- Transparency in business practices becomes a competitive advantage

Solutions and Best Practices: Successful brands are embedding sustainability and social responsibility into their core business operations, then communicating these efforts authentically rather than treating them as marketing add-ons. They're also engaging in genuine dialogue with consumers about industry challenges rather than avoiding difficult topics.

Challenge 8: Measurement and Attribution Complexity

The combination of digital marketing constraints, changing consumer behavior, and economic pressures makes it increasingly difficult to measure marketing effectiveness and attribute results to specific campaigns.

Strategic Implications:

- Traditional metrics like reach and frequency become less meaningful than engagement and conversion quality

- Customer lifetime value measurement becomes crucial for evaluating marketing investment returns

- Attribution modeling must account for longer, more complex consumer decision journeys

Solutions and Best Practices: Leading brands are investing in sophisticated customer data platforms that track consumer interactions across all touchpoints. They're also developing new metrics that better reflect the modern consumer journey and the true impact of marketing activities on brand value and consumer relationships.

Demographic Disruption: The Gen Z Factor

The arrival of Generation Z as legal consumers represents the most significant demographic shift in the alcohol industry since Baby Boomers came of age. Understanding this generation's unique characteristics and preferences is crucial for long-term marketing success.

The Moderation Movement

There isn't one clear reason for this, but experts point to a variety of factors. Gen Z's reduced alcohol consumption stems from multiple influences, including health consciousness, social media awareness, financial pressures, and different social patterns. Unlike previous generations who might have used alcohol as a social lubricant, Gen Z consumers are more comfortable with sobriety and view alcohol as one option among many rather than a social necessity.

This shift has profound implications for marketing strategies. Traditional approaches that emphasized social acceptance, stress relief, or celebration through alcohol consumption may actually alienate Gen Z consumers who view such messaging as outdated or inauthentic.

Digital-First Engagement Patterns

Shaped by digital connectivity, health consciousness, social values, and budget constraints, describes the complex factors influencing Gen Z purchase decisions. This generation's digital nativity means they expect seamless online experiences, transparent brand communications, and authentic social media presence.

However, digital marketing to Gen Z in the alcohol space is complicated by platform restrictions and advertising regulations. Brands must find creative ways to engage authentically while navigating these constraints.

Values-Driven Consumption

Gen Z consumers make purchasing decisions based on brand values alignment more than previous generations. They expect brands to take positions on social issues, demonstrate environmental responsibility, and operate with transparency. This creates both opportunities and risks for alcohol marketers who must navigate potentially controversial topics while maintaining broad appeal.

The Experience Economy Integration

prefer their cocktails canned, collabed and content-friendly reflects Gen Z's integration of consumption with social media sharing and experience creation. Products aren't just consumed—they're curated, shared, and integrated into personal brand building on social platforms.

This requires marketers to think beyond traditional product benefits to consider how their products enable consumer expression and social sharing. Packaging design, limited editions, and collaborative products become crucial elements of the marketing strategy.

Health and Wellness Integration

Gen Z's approach to health and wellness is more holistic than previous generations, considering not just immediate health impacts but long-term wellness, mental health, and social responsibility. This influences their alcohol consumption patterns and creates opportunities for brands that can authentically integrate wellness considerations into their positioning.

Strategic Recommendations for Gen Z Marketing

- Authenticity Over Polish: Gen Z prefers authentic, unpolished content over highly produced marketing materials

- Values Integration: Brand values must be genuine and consistently demonstrated across all business operations

- Experience Creation: Products should enable social sharing and personal expression

- Education Over Promotion: Focus on educating about quality, craftsmanship, and responsible consumption rather than promoting consumption itself

- Community Building: Create genuine communities around shared interests and values rather than just product consumption

Product Innovation: RTDs and No/Low Alcohol

The ready-to-drink (RTD) and no/low alcohol segments represent the industry's most dynamic growth areas, offering opportunities for brands to capture new consumers and respond to changing preferences.

The RTD Revolution

Whether they're traditionally non-alcoholic brands tapping into consumer nostalgia—like Sunny D or Welch's—or classic spirits companies forging new crossover partnerships—like Absolut and Ocean Spray or Captain Morgan and Pepsi—RTD beverages are clearly a hot commodity. This category's growth reflects consumer demand for convenience, portability, and innovation.

Market Dynamics: RTD beverages appeal to consumers seeking premium quality in a convenient format. They satisfy the desire for craft cocktail experiences without the complexity of home preparation. The category also benefits from strong social media shareability, with colorful, distinctive packaging that photographs well for social platforms.

Innovation Opportunities: Successful RTD innovations focus on authentic flavor profiles, premium ingredients, and distinctive positioning. Collaborations between alcohol brands and non-alcoholic brands create unique products that stand out in crowded retail environments while appealing to consumers' nostalgia and novelty-seeking behaviors.

No/Low Alcohol Market Expansion

Global Low & No Alcohol Beverages Market Size is valued at USD 25.7 Billion in 2024 and is predicted to reach USD 46.5 Billion by the year 2034 at a 6.2% CAGR during the forecast period for 2025-2034. This remarkable growth trajectory reflects fundamental changes in consumer attitudes toward alcohol consumption.

Consumer Motivations: The no/low alcohol trend is driven by health consciousness, lifestyle changes, and social acceptance of moderation. The majority (41%) of no/low consumers choose no/low options for health reasons, while others are motivated by fitness goals, medication considerations, or simply personal preference for moderation.

Quality Evolution: Early no/low alcohol products often compromised on taste and experience. Today's offerings focus on replicating the full sensory experience of traditional alcoholic beverages through advanced production techniques, premium ingredients, and sophisticated flavor development.

Innovation Strategies for Traditional Brands

Portfolio Extension: Established alcohol brands are successfully extending their portfolios into no/low segments, leveraging brand equity while accessing new consumer segments. This strategy allows brands to maintain a relationship with consumers during periods of moderation without losing them to competitors.

Technology Investment: Leading brands are investing in advanced production technologies that can create high-quality no/low alcohol products. These investments pay dividends not only in product quality but also in production efficiency and cost management.

Marketing Integration: Successful brands integrate no/low products into their overall brand story rather than treating them as separate entities. This approach maintains brand coherence while demonstrating commitment to consumer choice and responsibility.

Future Innovation Directions

Functional Benefits: The next wave of innovation combines no/low alcohol with functional ingredients like adaptogens, vitamins, and probiotics. These products appeal to health-conscious consumers seeking beverages that provide benefits beyond taste and refreshment.

Sustainability Focus: Environmental considerations increasingly influence product development, with brands exploring sustainable packaging, local sourcing, and carbon-neutral production processes as competitive differentiators.

Personalization Technology: Emerging technologies enable mass customization of flavor profiles and functional benefits, potentially allowing brands to create personalized products that match individual consumer preferences and health goals.

Premium Strategy Evolution: Beyond Traditional Premiumization

The evolution of premiumization strategies reflects changing consumer values and economic realities. IWSR also reported that "the only price band to see growth" in the U.S. in 2024 was super-premium beer. While premium segments continue to show resilience, the definition of "premium" is expanding beyond price points to encompass values, experiences, and authenticity.

Redefining Premium Value

Traditional premiumization focused primarily on product quality improvements and heritage storytelling. Today's premium positioning requires a more holistic approach that addresses consumer values around sustainability, social responsibility, and personal expression.

Craft and Artisanal Positioning: Premium brands are emphasizing craftsmanship, small-batch production, and artisanal techniques. This positioning appeals to consumers seeking authentic experiences and products with clear provenance and story.

Sustainability Premium: Environmental responsibility is becoming a key premium differentiator. Brands that can demonstrate genuine commitment to sustainable practices—from ingredient sourcing to packaging—can command premium pricing from environmentally conscious consumers.

Experience-Based Premiumization

Premium positioning increasingly focuses on the experiences brands create rather than just product attributes. This includes exclusive events, educational content, and community-building initiatives that justify premium pricing through enhanced consumer engagement.

Direct-to-Consumer Experiences: Premium brands are developing sophisticated direct-to-consumer platforms that offer personalized experiences, exclusive products, and educational content. These platforms allow brands to build deeper relationships with their most valuable customers while capturing higher margins.

Educational Content and Expertise: Premium brands are positioning themselves as educators and experts, providing content about production techniques, flavor profiles, and consumption occasions. This approach builds brand authority and justifies premium pricing through demonstrated expertise.

Limited Edition and Scarcity Strategies

Successful premium brands are using limited edition releases and genuine scarcity to create excitement and justify premium pricing. However, these strategies must be backed by authentic stories and genuine product differentiation to avoid consumer skepticism.

Collaborative Limited Editions: Partnerships with artists, chefs, and other premium brands create unique products that appeal to collectors and enthusiasts. These collaborations generate social media buzz while reinforcing premium positioning.

Seasonal and Occasion-Based Products: Premium brands are developing products specifically for seasonal consumption or special occasions, allowing them to command higher prices during peak demand periods while maintaining regular product lines.

Technology-Enhanced Premium Experiences

Advanced technology is enabling new forms of premium experiences, from augmented reality packaging to personalized product recommendations based on consumer preferences and purchase history.

Smart Packaging and Authentication: Premium brands are incorporating technology into packaging to ensure authenticity, provide educational content, and create interactive experiences that enhance perceived value.

Personalized Recommendations: Data analytics enable premium brands to provide personalized product recommendations and experiences that demonstrate an understanding of individual consumer preferences and occasions.

Digital Marketing in a Regulated Environment

Alcohol marketing in digital channels requires navigating complex regulatory requirements while effectively reaching target audiences. The intersection of federal regulations, platform policies, and evolving consumer expectations creates both challenges and opportunities for innovative marketers.

Platform Policy Navigation

Major digital platforms maintain strict policies regarding alcohol advertising, often exceeding federal regulatory requirements. Understanding these policies and developing compliant strategies is essential for digital marketing success.

Content Strategy Development: Successful alcohol brands develop content strategies that focus on brand values, heritage, and lifestyle rather than direct product promotion. This approach allows for platform compliance while building brand affinity and awareness.

Influencer Partnership Management: Influencer marketing requires careful management to ensure compliance with both platform policies and FTC requirements. Brands must thoroughly vet partnerships and provide clear guidelines for content creation and disclosure.

Regulatory Compliance in Digital Spaces

Federal regulations require age-gating, responsible consumption messaging, and specific disclosure requirements that must be integrated into digital marketing campaigns.

Age Verification Systems: Advanced age verification systems ensure compliance with federal requirements while providing seamless user experiences that don't significantly impact campaign effectiveness.

Responsible Consumption Integration: Successful brands integrate responsible consumption messaging naturally into their digital content rather than treating it as a compliance afterthought. This approach maintains message authenticity while meeting regulatory requirements.

Creative Compliance Solutions

Leading brands are developing creative approaches that achieve marketing objectives while remaining fully compliant with regulations and platform policies.

Lifestyle and Culture Focus: Brands successful in digital marketing focus on the lifestyle and cultural elements associated with their products rather than consumption itself. This approach builds brand affinity while remaining compliant with restrictions.

Educational Content Development: Educational content about production processes, ingredients, and history provides valuable information to consumers while building brand authority and expertise positioning.

Measurement and Optimization in Regulated Environments

Digital marketing measurement in regulated environments requires sophisticated approaches that account for compliance restrictions and attribution challenges.

Privacy-Compliant Analytics: Advanced analytics platforms enable detailed campaign measurement while maintaining consumer privacy and regulatory compliance. These systems provide insights necessary for optimization while protecting consumer data.

Engagement Quality Metrics: Successful brands focus on engagement quality rather than quantity, measuring meaningful interactions and brand affinity development rather than simple reach and impressions.

Case Study: Athletic Brewing's No-Alcohol Success

Athletic Brewing Company represents one of the most successful case studies in the growing no-alcohol beverage segment, demonstrating how authentic positioning and quality focus can build a thriving business in an emerging category.

Company Background and Positioning

Founded in 2017, Athletic Brewing positioned itself as a premium non-alcoholic beer company focused on active lifestyle consumers. The brand's positioning strategy avoided traditional "alcohol replacement" messaging, instead focusing on performance, recovery, and lifestyle alignment with health-conscious consumers.

Strategic Marketing Approach

Authentic Athletic Positioning: Athletic Brewing built its brand around genuine athletic lifestyle alignment rather than simply marketing to people avoiding alcohol. This authentic positioning attracted consumers who saw the brand as supporting their active lifestyle rather than representing a compromise or limitation.

Community Building: The company invested heavily in building communities around running, cycling, and other athletic activities. This approach created genuine brand affinity and word-of-mouth marketing among target consumers.

Quality-First Product Development: Rather than accepting the taste limitations common in early non-alcoholic beers, Athletic Brewing invested in brewing technology and processes to create products that compete on quality rather than just absence of alcohol.

Distribution and Growth Strategy

Direct-to-Consumer Focus: Athletic Brewing developed a sophisticated direct-to-consumer platform that provided subscription services, exclusive products, and personalized experiences. This approach built strong customer relationships while capturing higher margins.

Strategic Retail Partnerships: The company secured distribution in premium retailers and health-focused stores, reinforcing its positioning as a premium lifestyle product rather than a traditional beer alternative.

Geographic Expansion: Athletic Brewing executed a careful geographic expansion strategy that built strong regional presence before moving to new markets, ensuring adequate supply and marketing support in each area.

Marketing Innovation and Results

Content Marketing Excellence: The company developed exceptional content marketing around athletic performance, recovery, and lifestyle topics. This content provided value to target consumers while building brand authority and expertise positioning.

Influencer and Ambassador Programs: Athletic Brewing built successful ambassador programs with genuine athletes who used the products as part of their training and recovery routines. These authentic partnerships provided credible endorsements and social proof.

Event Marketing Integration: The company became a sponsor and participant in athletic events, providing product sampling and brand visibility to target consumers in relevant contexts.

Business Results and Impact

Athletic Brewing achieved remarkable growth, becoming the leading non-alcoholic beer brand in the United States and securing significant funding for continued expansion. The company's success demonstrated that quality products with authentic positioning could build substantial businesses in emerging categories.

Key Lessons for Industry Marketers

-

Authentic Positioning: Successful brands in emerging categories must find authentic positioning that resonates with target consumers rather than simply filling gaps in existing categories.

-

Quality Commitment: Product quality cannot be compromised in favor of category novelty. Consumers expect products that deliver on core functional benefits regardless of category innovation.

-

Community Building: Building genuine communities around shared values and lifestyle creates stronger brand loyalty than traditional advertising approaches.

-

Direct Consumer Relationships: Developing direct relationships with consumers provides valuable data, higher margins, and protection against retail distribution challenges.

-

Patient Growth Strategy: Sustainable growth requires careful market development and adequate resource support rather than rapid expansion without proper infrastructure.

Future Outlook: 2026-2027 Projections

The U.S. alcohol industry faces a future defined by transformation rather than traditional growth patterns. Across the 10 key markets covered by IWSR's No/Low-Alcohol Strategic Study, no/low volumes are forecast to expand at a CAGR of +4% between 2024 and 2028, with no-alcohol spearheading this with a +7% volume CAGR. This projection underscores the fundamental shift in consumer preferences that will continue reshaping the industry landscape.

Macroeconomic Environment and Consumer Behavior

The economic backdrop for the coming years presents both challenges and opportunities. After persistent inflation, geopolitical tensions, and varying levels of consumer confidence characterised 2024, the next 12 months will be marked by continued economic uncertainty, but also some promising growth opportunities. Marketers must prepare for continued consumer price sensitivity while identifying segments and occasions where premium positioning remains viable.

Income-based segmentation will become increasingly important as consumer behavior diverges between economic groups. Higher-income consumers are expected to maintain premium purchase patterns while reducing overall volume, whereas lower-income consumers will continue downtrading to more affordable options. This bifurcation requires sophisticated portfolio strategies that serve both segments without diluting brand positioning.

Category-Specific Growth Trajectories

Spirits Market Evolution: Based on a June 2025 news release, SipSource forecasts that after "growing decline levels seen between 2022 and 2024," sales of rum, U.S. whiskey, vodka, and brandy/cognac are expected to largely flatten by the first half of 2026, albeit in negative territory. This stabilization suggests the industry is approaching a new equilibrium after recent volatility, but volume growth in traditional categories will remain elusive.

Agave Spirits Dominance: The tequila and mezcal category continues its remarkable trajectory. SipSource further indicates that tequila/agave will continue to experience a "+1% rolling growth by mid-2026" with "sustained consumer interest in premium tiers (from $20-$100)". This sustained growth, even as other categories decline, positions agave spirits as the industry's most reliable growth engine. Brands not currently participating in this category should consider strategic entry points.

RTD Momentum: All of the top 10 RTD markets are forecast to register CAGR volume gains between 2023 and 2028, led by Brazil (+6%), Australia (+4%), Germany (+4%), the US (+3%) and Canada (+3%). The U.S. market's projected 3% CAGR represents a significant opportunity in an otherwise declining volume environment. However, increasing competition and market fragmentation mean success requires clear differentiation and strong brand positioning.

Premium Beer Opportunity: The price competitiveness of premium-plus beer and cider is proving to be a boon in the current macroeconomic landscape, with volumes rising by +2% in the first half of 2024, versus -3% declines for premium-plus spirits and wine. This affordability advantage positions premium beer as a potential beneficiary of consumer downtrading from spirits and wine, representing an unexpected growth opportunity.

Technology Integration and Digital Transformation

The integration of artificial intelligence and predictive analytics will fundamentally change how brands interact with consumers. Smart recommendations: AI-powered apps provide tailored drink suggestions based on user preferences. Brands that invest in sophisticated data platforms and personalization technology will gain significant competitive advantages in consumer acquisition and retention.

Blockchain technology will address growing consumer demand for transparency and authenticity. Blockchain for authenticity: Consumers can verify a product's origin and production process with blockchain. This technology enables brands to differentiate based on provenance, production methods, and sustainability claims with verifiable proof rather than marketing assertions.

Augmented reality will create new forms of consumer engagement that comply with regulatory restrictions while delivering compelling brand experiences. Augmented reality (AR) labels: AR-enabled packaging offers immersive storytelling and brand education. These technologies allow brands to provide rich content and experiences without requiring direct product promotion in regulated digital channels.

Sustainability as Competitive Imperative

Environmental responsibility will transition from a nice-to-have to an essential requirement for brand success. According to a 2024 NielsenIQ report, 85% of global consumers have shifted their purchase behaviour towards more sustainable options, including alcoholic beverages. This overwhelming consumer preference means brands without credible sustainability strategies will face increasing market pressure.

Packaging innovation will lead sustainability efforts. Traditional glass bottles face scrutiny for their environmental impact, driving innovation in alternative materials, refillable systems, and minimalist designs that reduce material usage and transportation costs. Brands that successfully implement sustainable packaging while maintaining premium positioning will capture environmentally conscious consumers.

Production practices will receive increased attention as consumers demand transparency around water usage, carbon emissions, and agricultural practices. Brands that can document and communicate sustainable production methods will differentiate in increasingly crowded markets.

Flavor Innovation and Global Influences

Consumer adventurousness in flavor exploration will continue expanding. According to Mintel, 57% of consumers say they enjoy trying drinks with unfamiliar ingredients. This openness creates opportunities for brands to introduce innovative flavor combinations and ingredients from global beverage traditions.

Fusion cocktails: Blending cultural influences, such as Japanese yuzu with Mexican mezcal represents the type of cross-cultural innovation that will define successful new products. Brands that authentically incorporate global influences while respecting cultural origins will capture consumer interest.

Regulatory Landscape Evolution

The regulatory environment will continue evolving in response to public health concerns, technological changes, and industry advocacy. Direct-to-consumer regulations will likely continue liberalizing in many states, creating opportunities for brands to build direct consumer relationships and capture higher margins.

Digital marketing regulations may become more restrictive as policymakers and platforms respond to concerns about youth exposure and responsible marketing practices. Brands must prepare for potentially tighter restrictions while developing compliant engagement strategies that remain effective.

Channel Dynamics and Distribution Evolution

On-premise recovery will continue but may never return to pre-pandemic levels as changed consumer habits around home consumption persist. Brands must balance on-premise support with growing off-premise and direct-to-consumer opportunities.

E-commerce and direct-to-consumer channels will continue growing, potentially accounting for 10-15% of total sales by 2027. This shift requires significant investment in fulfillment capabilities, digital marketing, and customer service infrastructure.

Retail consolidation will increase pressure on brands for promotional support and favorable positioning. Strong brands with clear differentiation will maintain negotiating leverage, while smaller brands may struggle for distribution and shelf space.

Strategic Imperatives for Future Success

Portfolio Optimization: Brands must ruthlessly evaluate their portfolios, focusing resources on products with clear growth potential and differentiation rather than maintaining legacy products that no longer resonate with modern consumers.

Digital Capability Building: Investment in digital capabilities—from e-commerce platforms to data analytics to social media management—becomes essential rather than optional. Brands lacking these capabilities will struggle to compete effectively.

Values Alignment: Authentic commitment to sustainability, social responsibility, and ethical business practices becomes foundational to brand building rather than marketing overlay. Gen Z and Millennials will increasingly make purchase decisions based on brand values alignment.

Innovation Velocity: The pace of consumer preference change requires faster innovation cycles and greater willingness to test new concepts. Brands that maintain rigid product development processes will struggle to keep pace with market evolution.

Direct Consumer Relationships: Building direct relationships with consumers—through D2C channels, subscription services, or community platforms—provides valuable data, higher margins, and protection against distribution challenges.

The future of the U.S. alcohol industry will favor brands that embrace change, invest in capabilities that match modern consumer expectations, and maintain authentic connections with their target audiences. Traditional competitive advantages around heritage and distribution are giving way to new success factors centered on value alignment, digital sophistication, and innovation velocity.

Conclusion and Actionable Recommendations

The U.S. alcohol industry stands at a crossroads between its traditional foundations and an emerging future shaped by fundamentally different consumer preferences, economic realities, and social values. The challenges outlined in this white paper—from Gen Z's moderation movement to premium strategy evolution to digital marketing complexities—represent both threats to established approaches and opportunities for brands willing to adapt.

Key Findings Synthesis

The data tells a clear story: volume growth in traditional categories is ending, replaced by a new paradigm where success depends on value creation rather than volume expansion. For the first time in nearly three decades, spirits volumes declined in 2023, yet value increased as consumers traded up within smaller purchase occasions. This pattern reveals a marketplace where quality, authenticity, and brand values alignment matter more than ever.

The no/low alcohol segment's explosive growth—projected at 4% CAGR through 2028 with no-alcohol specifically growing at 7%—demonstrates that consumer interest in moderation is real, sustained, and represents a genuine market opportunity rather than a fad. Brands that dismissed this trend as temporary must now recognize it as a permanent market evolution requiring a strategic response.

RTD beverages' continued momentum, projected to grow 3% annually through 2028, shows that convenience and innovation continue attracting consumers despite overall volume declines. However, increasing fragmentation means success requires clear differentiation rather than simple category participation.

Perhaps most significantly, the generational shift in attitudes toward alcohol consumption represents structural rather than cyclical change. Gen Z's health consciousness, values-driven purchasing, and comfort with moderation create fundamentally different marketing challenges than previous generations presented. Brands that attempt to apply traditional marketing playbooks to this audience will struggle to build lasting relationships.

Strategic Recommendations for Alcohol Marketers

1. Develop Comprehensive No/Low Alcohol Strategies

Rather than treating no/low alcohol as peripheral to core business, leading brands must integrate these offerings into their strategic portfolios. This doesn't mean every brand needs no/low products immediately, but every marketer needs a clear perspective on how these trends affect their business and what response is appropriate.

For established brands with strong equity, extending into no/low alcohol leverages brand value while accessing new consumers and occasions. Athletic Brewing's success demonstrates that authentic positioning and quality focus can build substantial businesses in this space. Traditional alcohol brands have advantages through existing brand recognition and distribution relationships.

Implementation requires commitment to quality and authenticity. Early no/low products often compromised on taste and experience, limiting their appeal. Modern consumers expect these products to deliver full sensory experiences comparable to traditional alcoholic beverages. Brands that skimp on product development to rush into this space will struggle against competitors willing to invest appropriately.

2. Implement Sophisticated Demographic Segmentation

The days of broad demographic targeting are ending. Economic pressures are creating stark differences in purchasing behavior between income groups, while generational differences in attitudes toward alcohol require fundamentally different marketing approaches.

Marketers must develop a detailed understanding of their specific target segments beyond traditional demographics. Psychographic profiling, values alignment assessment, and behavioral analysis provide insights necessary for effective positioning and communication. Generic messaging about quality or heritage no longer suffices when consumers make purchasing decisions based on complex value calculations.

For Gen Z specifically, marketers must recognize that traditional alcohol marketing approaches may alienate rather than attract. This generation expects brands to take positions on social issues, demonstrate environmental responsibility, and communicate authentically rather than through polished advertising. The brands successfully building Gen Z loyalty focus on values alignment, community building, and authentic engagement rather than product promotion.

3. Build Direct-to-Consumer Capabilities

Direct-to-consumer channels provide multiple strategic advantages: higher margins, valuable consumer data, opportunities for personalization, and protection against retail consolidation. While D2C may never represent the majority of sales for most brands, the strategic importance exceeds volume contribution.

Implementation requires significant investment in technology platforms, fulfillment capabilities, and digital marketing expertise. Brands must develop sophisticated approaches to customer acquisition, retention, and lifetime value optimization. However, the data generated through direct relationships provides insights impossible to obtain through traditional distribution channels.

Subscription models deserve particular attention as they provide predictable revenue, high customer lifetime value, and opportunities for experimentation with limited-edition products. Athletic Brewing and numerous wine brands have demonstrated subscription success, but the model remains underdeveloped in spirits categories.

4. Embrace Authentic Sustainability Commitments

With 85% of global consumers shifting purchase behavior toward sustainable options, environmental responsibility becomes essential rather than optional. However, authenticity is critical—consumers quickly identify and reject superficial sustainability claims.

Effective sustainability strategies integrate environmental responsibility into core business operations rather than treating it as a marketing overlay. This includes sustainable sourcing, production efficiency, packaging innovation, and transparent communication about challenges and progress. Brands that acknowledge difficulties while demonstrating commitment build more credibility than those claiming perfection.

Packaging innovation provides visible sustainability differentiation. Alternatives to traditional glass bottles, refillable systems, and minimalist designs that reduce material usage all demonstrate commitment while potentially reducing costs. These innovations must maintain premium positioning while delivering environmental benefits.

5. Develop Agile Digital Marketing Approaches

Regulatory constraints and platform policies create unique challenges for alcohol marketing in digital spaces. However, these limitations also create opportunities for creative approaches that build stronger brand connections than traditional advertising.

Content marketing focused on lifestyle, culture, and values rather than direct product promotion enables platform compliance while building brand affinity. Educational content about production methods, ingredients, and consumption occasions positions brands as experts and resources rather than mere product sellers.

Influencer partnerships require sophisticated management to ensure compliance while achieving marketing objectives. Brands must thoroughly vet partnerships, provide clear guidelines, and monitor content to maintain regulatory compliance. However, authentic influencer recommendations carry more weight with younger consumers than traditional advertising.

Community building through owned platforms and direct engagement creates loyal consumer bases that transcend individual purchase occasions. Brands that invest in building genuine communities around shared interests and values create sustainable competitive advantages resistant to promotional pressures from competitors.

Final Perspective

The transformation of the U.S. alcohol industry from volume-driven growth to value-focused strategy represents both challenge and opportunity. Brands clinging to traditional approaches face declining relevance with emerging consumer segments. However, those willing to embrace change, invest in new capabilities, and authentically align with evolving consumer values have opportunities to build stronger, more profitable businesses.

Success in this new era requires courage to challenge established assumptions, willingness to experiment with new approaches, and commitment to authentic brand building rather than superficial marketing tactics. The brands that thrive through 2027 and beyond will be those that recognize the industry's transformation as permanent rather than a temporary disruption.

For marketers specifically, the imperative is clear: develop a deep understanding of changing consumer preferences, build capabilities that match modern expectations, and create authentic brand narratives that resonate with values-driven consumers. The tools and tactics that built successful brands in past decades may not suffice for the future, but the fundamental principles of understanding consumers, delivering value, and building trust remain eternally relevant.

The alcohol industry's new era demands new thinking, new capabilities, and new courage. The marketers who embrace this reality and lead their organizations through transformation will shape the industry's future success.

One-Page Executive Summary

NAVIGATING THE NEW ERA: U.S. Alcohol Industry Marketing Strategies

Industry Snapshot: The U.S. alcohol industry is experiencing its most dramatic transformation in 30 years, with first-time spirits volume declines (-2% in 2023) signaling fundamental shifts in consumer behavior, generational preferences, and purchasing patterns.

Critical Challenges:

- Volume Decline: Traditional growth strategies based on volume expansion are obsolete

- Gen Z Moderation: Younger consumers drinking less, demanding different brand values

- Economic Pressure: Inflation driving selective purchasing and downtrading

- Premiumization Plateau: Traditional trade-up strategies showing fatigue

- Digital Complexity: Regulatory constraints complicating digital marketing

- Authenticity Demands: Consumers expecting genuine sustainability and social responsibility

Key Growth Opportunities:

- No/Low Alcohol: Projected 4% CAGR through 2028, adding $4+ billion in value

- RTD Beverages: 31% growth in 2023, reaching $510 million market value

- Agave Spirits: Only major category growing, with continued +1% trajectory

- Super-Premium Beer: Growing +1.5% despite overall beer decline

- Direct-to-Consumer: Higher margins and valuable consumer data

Strategic Imperatives:

- Develop authentic no/low alcohol portfolio extensions

- Implement sophisticated demographic and psychographic segmentation

- Build direct-to-consumer capabilities and data platforms

- Integrate sustainability into core operations, not just marketing

- Create compliant digital strategies focused on values and community

2026-2027 Outlook: Economic uncertainty will persist, but clear opportunities exist in health-conscious segments, premium positioning with affordability considerations, and technology-enabled personalization. Brands that embrace transformation will thrive; those clinging to traditional approaches risk obsolescence.

Bottom Line: Success requires courage to challenge assumptions, investment in new capabilities, and authentic alignment with evolving consumer values. The industry's new era demands new thinking—marketers who lead this transformation will shape the future.